Investors

Beyond the latest financial techniques, we have developed exclusive solutions in the field of quantitative analysis:

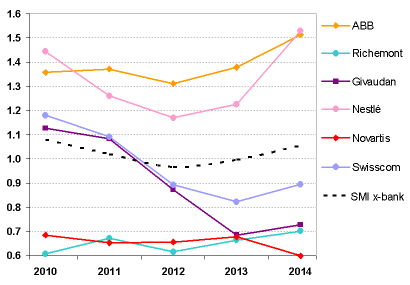

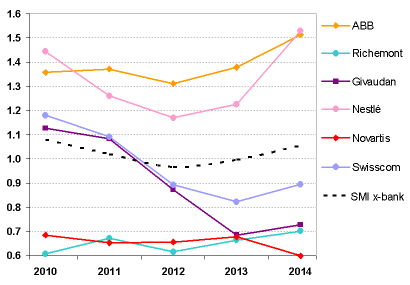

- T-ratio

to determine the tax efficiency of companies and anticipate the forthcoming legislative changes

to determine the tax efficiency of companies and anticipate the forthcoming legislative changes - Measures of market risk and liquidity risk

With specialist skills in Swiss and international taxation, we also offer you the investments most suitable to your personal tax situation.

Allocation strategy alone is unable to reduce risks when all asset classes move in the same direction. For example, the recent Chinese financial crisis has caused the simultaneous fall of the stocks, corporate bonds and commodities around the world!

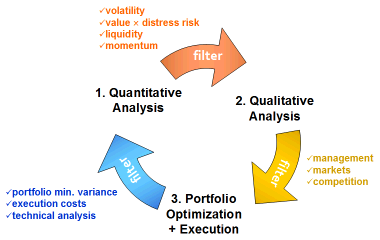

To address this issue, we systematically apply portfolio optimization following the pioneering work of H. Markowitz (Nobel prize in economy). This solution, which permits a better diversification by measuring how assets behave relative to each other, is an integral part of our investment process:

Companies

We help your firm adapt in the face of new tax norms.

The 3rd series of corporate tax reforms (CTR III) brings you, from 2019, new opportunities for savings. Let us explain to you how to make the most of it.

Analysis of tax efficiency

With the T-ratio, check the tax efficiency of your company... today as well as after the implementation of the CTR III in 2019.

You can thus anticipate the forthcoming legislative changes to establish your budgets and better plan your investments.